Update: Independent Dispute Resolution Fee Passthrough for Self-funded Groups

When the federal No Surprises Act created a new way to resolve billing disputes, the Blue Cross Blue Shield Association (BCBSA) decided temporarily, that each local Blue plan (host plan) would pay the dispute resolution fees for cases with providers in their area—even if the member belongs to a different Blue plan (home plan).

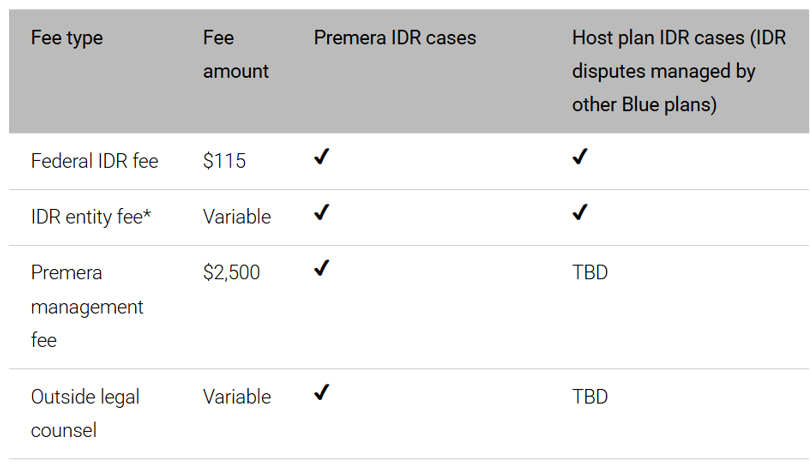

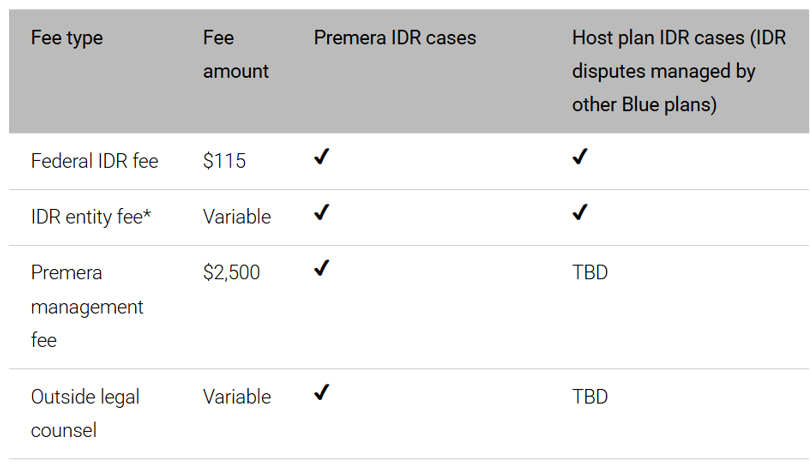

Starting January 1, 2026, Premera will begin passing through Independent Dispute Resolution (IDR) fees to self-funded employer groups for disputes managed by other Blue Cross Blue Shield plans.

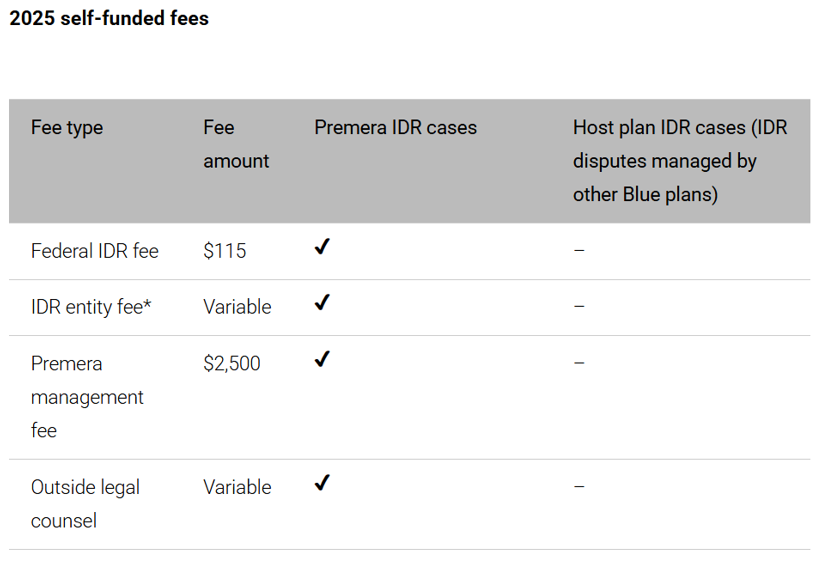

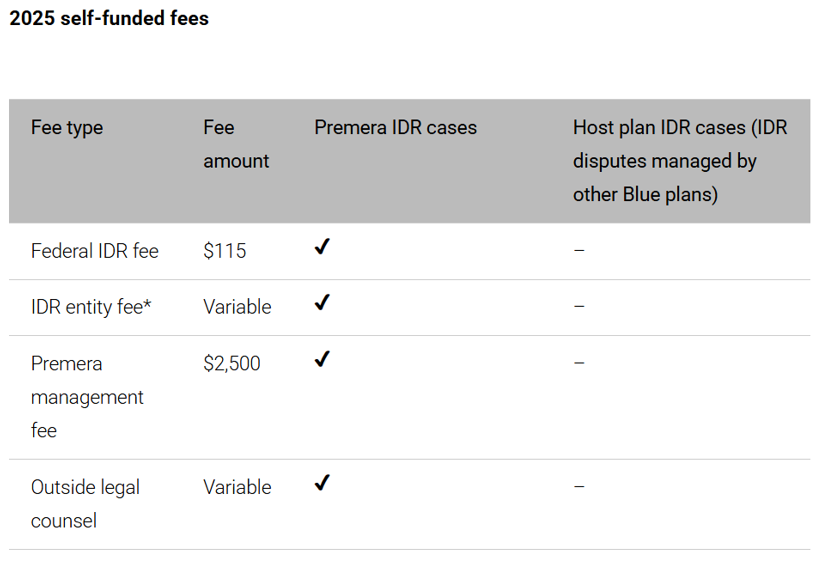

*Refunded if plan prevails in arbitration

Passing fees to the member’s home plan helps ensure consistent handling of IDR fees across all Blue plans and aligns with other national carriers and updated BCBSA guidance. It also helps prevent local Blue plans in certain markets from being disproportionately impacted by a small handful of private equity backed provider groups—who were responsible for 60% of IDR requests 2024.

What this means for you:

- When an IDR case involving a covered group member is managed by another Blue plan, the IDR fees will be passed to the self-funded group. We’ll include applicable IDR fees in the monthly claims invoice and the accompanying IDR reporting.

Questions?

Reach out to your Premera account manager.